Jumpstart Teen Checking Account

.png)

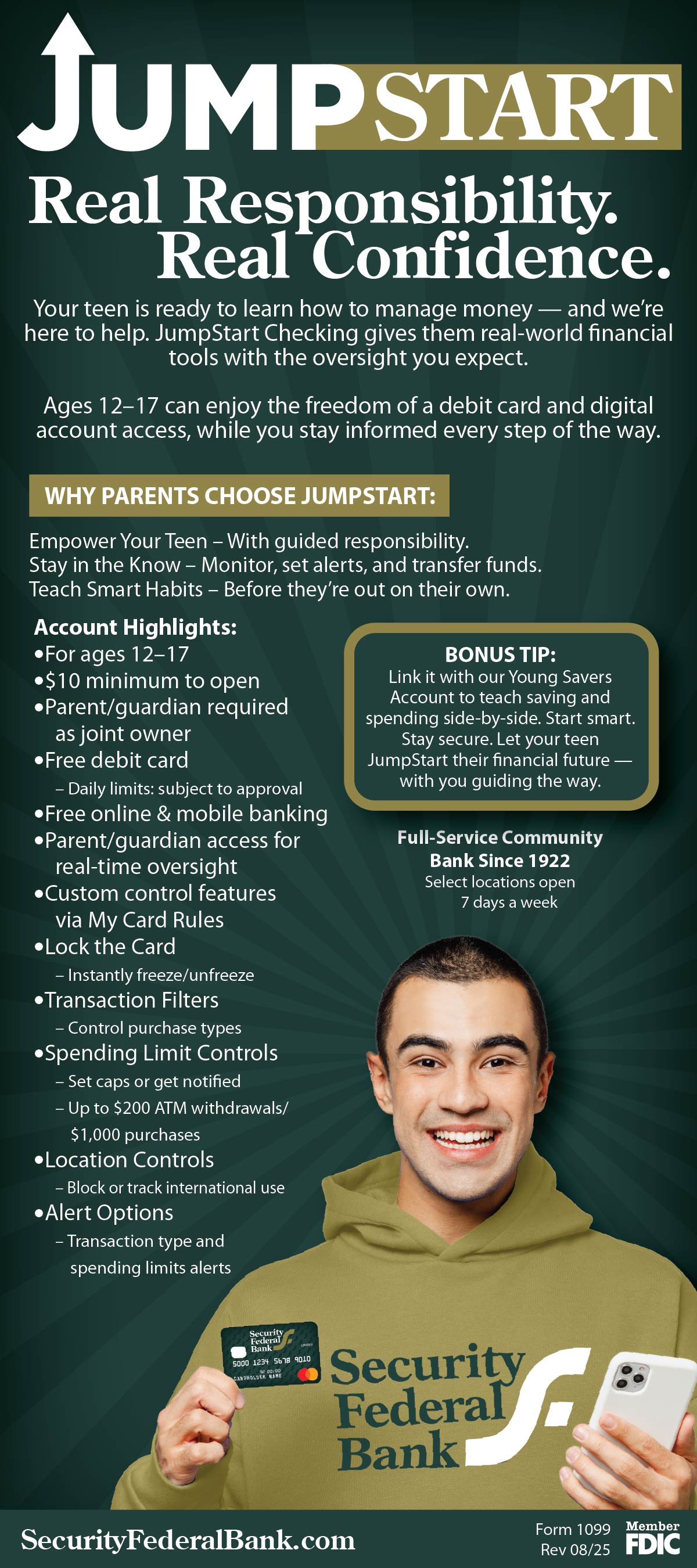

We’re passionate about teaching healthy financial habits for generations to come. Start your teen off with just a $10 deposit.

Mobile Banking

Debit Card1

Parental Oversight

Jumpstart teen checking accounts provide a secure and convenient platform for teens to manage their money independently. With features tailored for young adults, such as a dedicated debit card for teens, online banking, and mobile app access, teens can gain valuable financial skills while parents maintain peace of mind with oversight capabilities. Our goal is to empower teens to make informed financial decisions early on, setting them up for a lifetime of financial success.

- Jumpstart Checking is a checking account for teens ages 12 to 17 that requires a parent/joint owner also be on the account.

- The teen is eligible for a free debit card1.

- Choose a debit card design that fits your personality and interests.

- Design options include: Music, Sports, Camo, and Kittens

- Comes with ATM and purchase limits in place.

- Daily ATM limits are set at $200 and daily purchase limits are set at $1000 unless lowered by the adult on the account

- Choose a debit card design that fits your personality and interests.

- Both the teen and adult will be setup with a Digital Banking ID for online banking and the Security Federal Bank app

- For additional oversight, the parent/joint owner can set up banking alerts and/or restrictions.

- Sign into Online Banking or the Security Federal Bank app

- Click Card Management

- Click Alerts & Protections

- Protection Options- Choose to receive notification of all transactions

- Locations - Choose to block all International transactions or send notifications when an International transaction processes

- Merchant Types - Choose to block certain Merchant Types or receive notification when certain Merchant Type transactions process

- Merchant Types include: Age Restricted Merchants, Department Stores, Entertainment Merchants, Gas Stations, Grocery Stores, Household Stores, Personal Care, Restaurants, Travel and Other

- Transaction Types - Choose to block certain Transaction Types or receive notification when certain Transaction Types process

- Transaction types include: ATM, eCommerce, In Store, Mail/Phone Order, Recurring and Other

- Spending Limits - Set up Transaction and Monthly Spending Limits

- Spending Limit - Transactions over the amount set will be blocked and an alert will be sent.

- Spending Alert - Transactions over the amount set will trigger an alert.

- Monthly Spending Limit - Transactions that would bring your monthly spending total over the amount set will be blocked and an alert will be sent.

- Monthly Spending Alert - Transactions that bring your monthly spending total over the amount set will trigger an alert.

- Free eStatements

- Paper statements available for $3 per month

- Minimum Deposit to Open - $10

- No monthly service charge

- No minimum balance requirements

Account openings and credit are subject to bank approval

1 Subject to approval

Sign up to receive the Security Federal Bank newsletters

* indicates required fields

Thank you for signing up!

Someone from our office will reach out to you soon, if necessary.